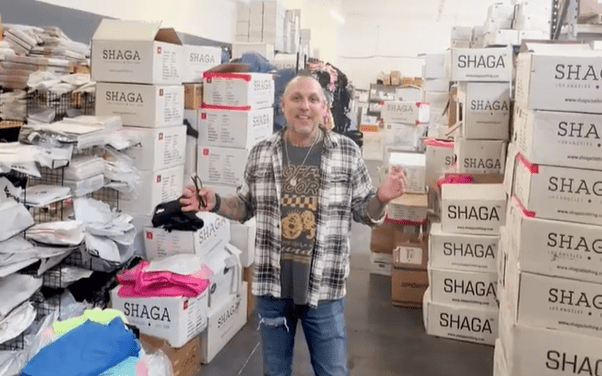

For over a decade, entrepreneur Oren Adani has been shaping the Las Vegas souvenir scene with his wholesale apparel company, 123 Goal. Known for supplying custom merchandise to major retailers and entertainment brands, 123 Goal has grown from a single retail kiosk into a multi-property operation with a national footprint.

The driving force behind Adani’s small business growth? Access to affordable commercial real estate financing.

Adani partnered with TMC Financing and leveraged the Small Business Administration’s (SBA) 504 commercial real estate financing program. With just a 10% down payment, the program allowed him to acquire two Las Vegas properties, transforming 123 Goal from a single-location operation into a scalable enterprise with room to grow.

Two SBA 504 Loans, One Streamlined Operation

As 123 Goal expanded, leasing space became increasingly limiting. Rising costs, scattered inventory, and logistical inefficiencies made it difficult to keep up with demand.

“We were paying thousands each month for rented storage,” Adani explains. “Our previous leased location wasn’t centralized, which made operations less efficient. By acquiring these two properties, and housing all our inventory on site, we’re in a much better position to manage workflow and respond quickly to customer needs.”

The SBA 504 loan is a financing solution designed to help small business owners purchase, renovate, or refinance commercial real estate with below-market, fixed interest rates for 25 years. The program offers up to 90% financing with no balloon payment, allowing a path to ownership that supports expansion, stabilizes occupancy costs, and preserves cash flow.

First SBA 504 Loan: 5419 South Decatur Boulevard

In October 2022, Adani secured his first SBA 504 loan to purchase a 13,230-square-foot building on South Decatur Boulevard. The property provided space for large-scale printing equipment and inventory, allowing 123 Goal to consolidate operations and eliminate outsourced warehouse costs.

Second SBA 504 Loan: 5220 South Pecos Road

In December 2023, Adani closed on a second SBA 504 loan to acquire an 18,308-square-foot building on South Pecos Road. This expansion gave his company even more room to grow, with added production capacity and proximity to key customers on the Las Vegas Strip.

“Location is everything,” says Adani. “Being near Las Vegas Boulevard is essential to our business, but a conventional loan was out of our budget. The SBA 504 loans gave us access to prime locations that help us respond faster and operate more efficiently.”

Both SBA 504 loans were facilitated by Chris Hunter, Business Development Officer at TMC Financing, who worked closely with Adani.

Both SBA 504 loans were facilitated by Chris Hunter, Business Development Officer at TMC Financing, who worked closely with Adani.

The SBA 504 program is a powerful tool for entrepreneurs like Oren,” says Hunter. “It makes property ownership attainable with a low down payment, and many business owners don’t realize they can use the program more than once. That’s how Oren was able to secure two properties and position his business for continued growth.

A Business with Local Roots and National Reach

Founded in 2009, 123 Goal began as a kiosk selling soccer uniforms. Today, the company supplies custom apparel and souvenirs to CVS, ABC Stores, truck stops, Caesars Entertainment, MGM Resorts, Cirque du Soleil, and even the Las Vegas Sphere. Their products are a staple in Las Vegas souvenir shops and are expanding into new markets, including a planned rollout of 28 stores in Houston.

“The 504 program gave me the flexibility to grow without compromising cash flow,” Adani says. “We’re able to serve more customers, stock more inventory, and plan for the future with confidence.”

A Foundation for the Future

Ownership has already driven meaningful changes to how 123 Goal operates and plans for the future:

- Greater flexibility to manage inventory and production

- Stable occupancy costs that support long-term planning

- Improved customer service and fulfillment speed

- Active plans to expand into new markets

“Owning our properties instead of leasing has completely changed the way we operate,” Adani concludes. “It’s not just about saving money, it about building a foundation for long-term success.”

With multiple SBA 504 loans under his belt and a growing portfolio of retail partners, Adani is building a business that’s not only scalable but sustainable.

Ready to explore your own path to ownership? Contact TMC Financing to learn more about the SBA 504 loan program and how it can help your business expand.